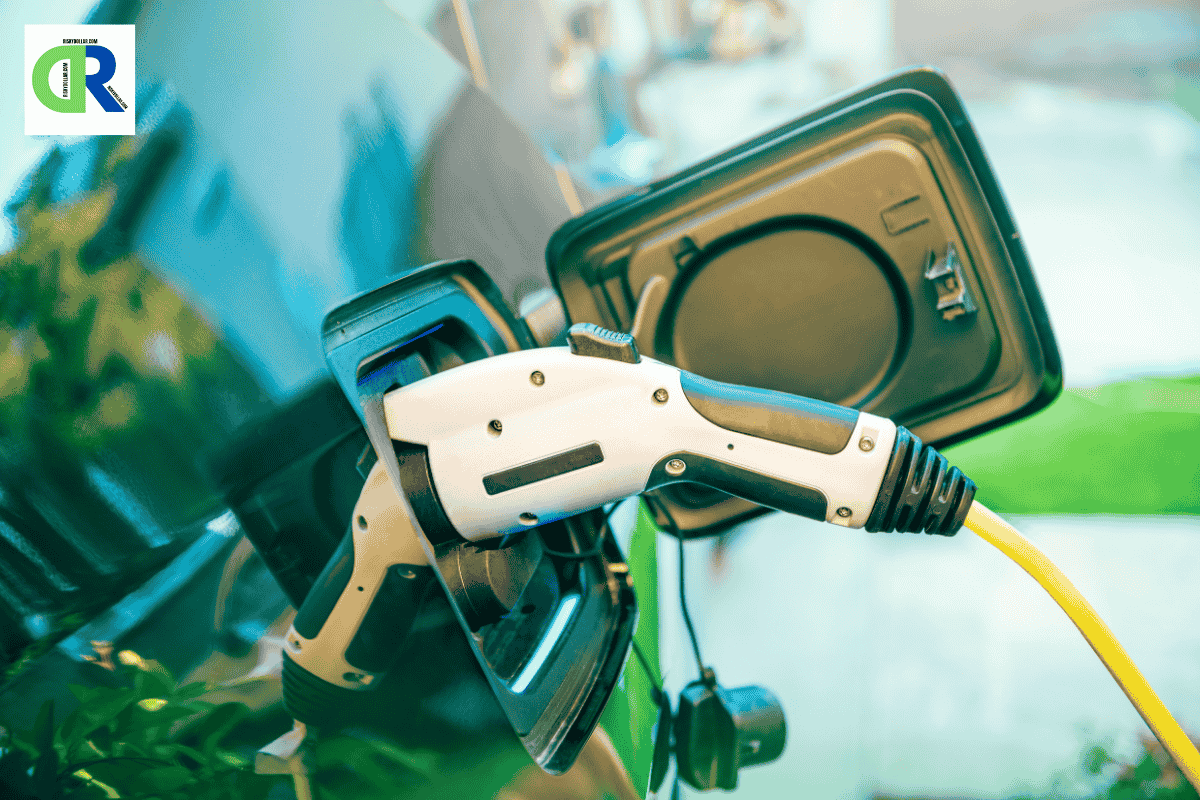

The electric vehicle revolution in India is no longer a distant dream. it’s happening right now. As the country moves toward a cleaner, technology-driven future, electric mobility has become one of the most exciting investment opportunities of 2025. Supported by government incentives, rising fuel prices, and increased environmental awareness, EV stocks in India are entering a long-term growth phase.

Let’s explore the best EV sector stocks in India, understand their potential, and see how you can benefit from this transformation.

Also Read : Top 5 Mid-Cap Mutual Funds to Invest in 2025

Why EV Stocks Are the Future

The Indian electric vehicle market is projected to grow at over 40% CAGR between 2024 and 2030, driven by both consumer demand and policy support. Government initiatives such as FAME-II (Faster Adoption and Manufacturing of Hybrid & Electric Vehicles) and the PLI scheme for advanced battery manufacturing are encouraging companies to scale up production.

Electric vehicles are no longer limited to a niche audience they are becoming mainstream. Two-wheelers, three-wheelers, buses, and even trucks are now being electrified. This means that both vehicle manufacturers and component suppliers will benefit, creating multiple investment opportunities.

Top EV Sector Stocks in India for 2025

1. Tata Motors Ltd

Tata Motors is India’s market leader in electric passenger cars, offering models like the Nexon electric vehicle, Tigor electric vehicle, and Punch EV. The company is also investing heavily in battery technology through Tata Agratas Energy Storage Solutions.

Why to invest:

- Strong brand trust and extensive service network.

- Consistent focus on electric vehicle innovation and affordability.

- Backed by Tata Group’s ecosystem in power, battery, and software.

Risk: High R&D costs and intense competition may pressure margins.

2. Mahindra & Mahindra (M&M)

Mahindra is emerging as a key electric vehicle player with its “Born Electric” SUV lineup and partnerships with global EV tech firms. It aims to capture both urban and rural markets through affordable EVs.

Why to invest:

- Strong engineering capability.

- First-mover advantage in electric SUVs.

- Diversified portfolio reduces business risk.

Risk: Execution delays in launching new models may slow growth.

3. TVS Motor Company

TVS Motor is a major force in the two-wheeler electric vehicle segment with its iQube Electric scooter, which is gaining fast popularity. The company plans to expand its electric vehicle portfolio and export network by 2026.

Why to invest:

- Early mover advantage in 2-wheelers.

- Strong brand image and after-sales network.

- Increasing exports in emerging EV markets.

Risk: Competition from Ola Electric and Hero MotoCorp’s EVs could affect pricing.

4. KPIT Technologies

KPIT isn’t a vehicle maker but a software powerhouse that provides EV control systems, battery management software, and connected mobility solutions to global automakers.

Why to invest:

- Niche positioning in electric vehicle software and AI-based systems.

- Global client base ensures stable earnings.

- Plays a crucial role in the digital transformation of mobility.

Risk: High dependence on foreign clients could affect margins during global slowdowns.

5. JBM Auto Ltd

JBM Auto manufactures electric buses, charging systems, and electric vehicle components. Its growing order book from government transport bodies makes it one of the most promising electric vehicle ecosystem players.

Why to invest:

- Strong foothold in public transport electrification.

- End-to-end electric vehicle solutions (vehicles + charging).

- Rising demand for electric city buses.

Risk: Heavy reliance on government contracts can impact stability.

6. Ashok Leyland

Ashok Leyland, India’s leading commercial vehicle manufacturer, is focusing on electric buses and trucks through its subsidiary Switch Mobility.

Why to invest:

- Massive opportunity in electric commercial vehicles.

- Government support for electric vehicle buses in urban transport.

- Strong research and production base.

Risk: Profitability depends on EV policy implementation speed.

7. Bajaj Auto

Bajaj Auto, a legacy two-wheeler brand, has entered the electric vehicle race with its Chetak Electric scooter. The company is expanding production capacity and exploring battery partnerships.

Why to invest:

- Trusted name in affordable mobility.

- Growing EV distribution network.

- Diversification into electric three-wheelers.

Risk: Market share pressure from new-age electric vehicle startups.

Risks of Investing in EV Stocks

While the electric vehicle industry presents tremendous growth potential, investors should also stay cautious of the challenges involved. One of the biggest risks is the high capital requirement building electric vehicle infrastructure, battery plants, and R&D facilities demands massive investment, which can strain company finances. Another key concern is technology risk. Battery chemistry and EV components evolve rapidly, and a sudden breakthrough can make existing models or technology obsolete.

The policy dependence of the electric vehicle industry also poses uncertainty, as government incentives and subsidies play a major role in sustaining profitability. Additionally, competition is intensifying with global EV giants entering the Indian market, potentially squeezing domestic manufacturers’ market share.

To manage these risks, investors should diversify their exposure across different parts of the electric vehicle ecosystem such as manufacturing, battery production, software solutions, and component suppliers rather than betting on just one segment.

How to Invest in EV Stocks

There are several ways to participate in India’s fast-growing electric vehicle sector. The simplest is through direct stock purchases on NSE or BSE, where investors can buy shares of leading electric vehicle companies. Another option is to invest in EV-themed mutual funds or ETFs, which provide diversified exposure across multiple companies in the electric mobility ecosystem. Those who prefer a disciplined approach can opt for Systematic Investment Plans (SIPs) in auto sector funds, spreading their investments over time. For long-term investors, holding EV stocks for 3–5 years or more can help capture the full growth potential as the industry matures. It’s important to focus on companies with strong financials, low debt levels, and a clear, sustainable electric vehicle roadmap before investing.

Future of EV Investments in India

India’s electric vehicle market stands at a defining moment. With a target of achieving 30% electric vehicle penetration by 2030, the government is supporting this transition through initiatives in infrastructure development, battery manufacturing, and renewable energy integration. As technology improves and battery costs decline, electric vehicles are becoming more affordable and accessible to the masses. This growing acceptance will drive demand across all categories from scooters and buses to passenger cars and trucks. Experts predict that electric vehicle stocks could emerge as one of the top-performing sectors of the next decade, much like how the IT sector transformed India’s economy in the early 2000s.

Conclusion

The electric vehicle revolution is transforming India’s automobile industry and creating exciting opportunities for investors. Companies like Tata Motors, Mahindra & Mahindra, TVS Motor, KPIT Technologies, and JBM Auto are leading this charge through their innovations in vehicles, software, and EV infrastructure. For investors who believe in India’s green mobility future, adding a few strong electric vehicle stocks to their portfolio in 2025 could be a smart long-term move. Success in this space requires patience, research, and confidence in innovation. The road ahead is electric and those who invest early stand to benefit from India’s sustainable transformation.

Disclaimer: The investment tips and opinions given here are the personal opinions of experts. These are not the opinions of Riskydollar or its team. Riskydollar advises all readers to consult a certified financial advisor before making any investment.