Introduction

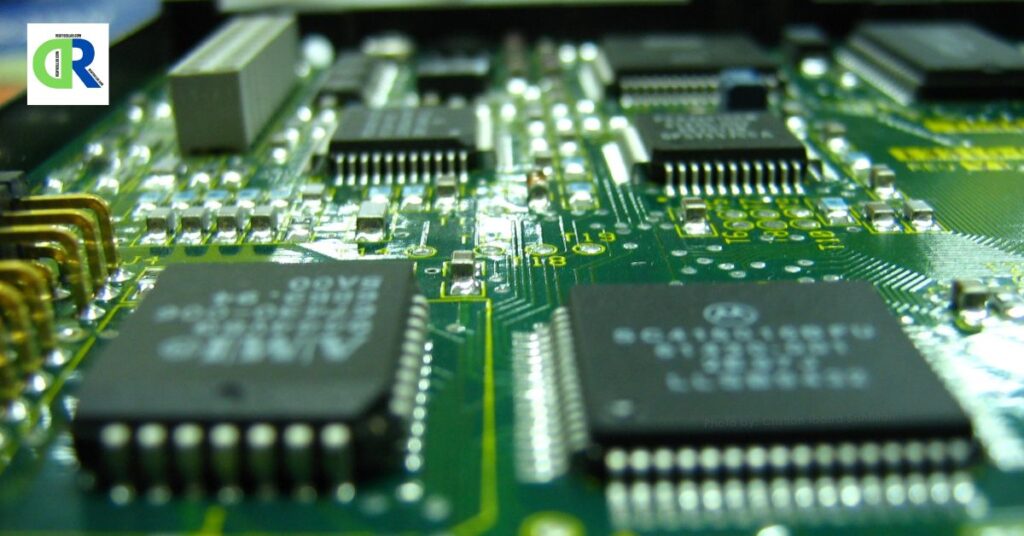

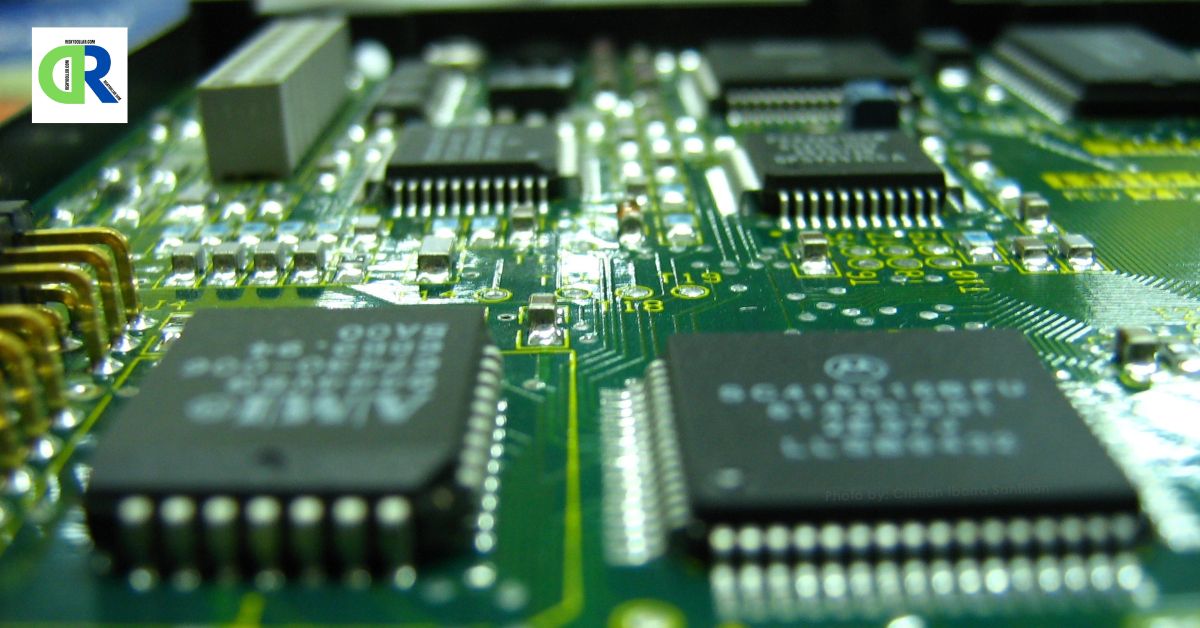

Semiconductors are the lifeblood of modern technology. From mobile phones and computers to electric cars and industrial equipment, these small chips are the driving force behind almost every electronic device we use.In India, semiconductors are becoming increasingly important as the country aims to reduce dependency on imports and develop a self-reliant electronics ecosystem. Thanks to government programs such as the Production Linked Incentive (PLI) scheme and the India Semiconductor Mission (ISM), India is steadily strengthening its capabilities in semiconductor design, testing, and production.

For investors, this emerging industry offers unique opportunities. While India does not yet have large-scale semiconductor manufacturing comparable to Taiwan or South Korea, domestic companies are making strides in chip design, packaging, assembly, and electronic manufacturing services. This blog explores the top semiconductor stocks in India, the growth trends, and why now may be the right time to consider investing.

Why Semiconductor Stocks Are Gaining Attention

The global Semiconductor Stocks shortage over the past few years highlighted the critical importance of these chips. Disruptions caused by the pandemic and surging demand for electronics exposed vulnerabilities in supply chains, affecting everything from cars to smartphones. India recognised the risks of relying heavily on imports and is actively promoting local manufacturing to become a competitive player in the global semiconductor ecosystem.

Government policies are a key driver behind this expansion. Programs like the PLI scheme and Design-Linked Incentives (DLI) encourage companies to invest in manufacturing and chip design. The India Semiconductor Mission seeks to develop a complete ecosystem that includes chip design, manufacturing, and testing capabilities. Combined with India’s growing domestic demand for electronics and rising global investment interest, these initiatives make semiconductor stocks highly attractive for long-term investors.

Understanding the Semiconductor Ecosystem

The semiconductor ecosystem is composed of several interconnected segments. Companies specializing in chip design develop the structure and technical specifications for integrated circuits. Fabrication plants (fabs) manufacture chips at scale, often requiring billions of dollars in investment. Packaging and testing companies ensure chips are ready for integration into end products, while electronics manufacturing service (EMS) providers assemble chips into devices like smartphones, TVs, and appliances. In India, most companies focus on chip design, packaging, and EMS, while fabs are still in development. Understanding this ecosystem is crucial for investors who want to identify opportunities across different stages of the semiconductor value chain.

Also Read : Best Semiconductor Stocks to Invest in 2025 — Global & Indian Picks for Smart Investors

Top Semiconductor Stocks in India

1. Tata Elxsi

Tata Elxsi specializes in design and engineering services for automotive electronics, IoT, and healthcare devices. The company focuses on designing chips, developing embedded systems, and providing AI-based solutions With the Tata Group actively exploring semiconductor manufacturing, Tata Elxsi is well-positioned to benefit from future growth in chip design and integration services.

2. Dixon Technologies

Dixon is a leading electronics manufacturing services company in India. While it does not produce chips directly, it integrates semiconductors into consumer electronics and appliances. The company is exploring packaging and assembly, which aligns with government initiatives promoting domestic electronics manufacturing.

3. ASM Technologies

ASM Technologies provides engineering and R&D services, including semiconductor design and embedded system solutions. As India scales up local chip production, demand for design and verification services is expected to increase, creating growth opportunities for companies like ASM.

4. Vedanta Limited

Vedanta, a metals and mining giant, is entering the semiconductor sector through a partnership with global technology firms to establish a large-scale fabrication plant in Gujarat. This venture positions Vedanta as a potential long-term leader in India’s chip manufacturing ecosystem.

5. SPEL Semiconductor

SPEL specializes in semiconductor packaging and testing (OSAT). It is one of India’s few companies focusing purely on back-end semiconductor processes, making it a unique investment option in the domestic market.

6. MosChip Technologies

MosChip specializes in ASIC design, developing embedded systems, and offering IoT solutions It caters to global clients and has shown consistent growth due to increasing demand for design and development services in semiconductor-related applications.

7. Sasken Technologies

Sasken offers product engineering and semiconductor-related R&D services. It works with global semiconductor companies on chip development, testing, and integration, positioning it well to benefit from the growing Indian market.

8. RIR Power Electronics

RIR Power Electronics focuses on power semiconductor devices, essential for industrial, automotive, and renewable energy applications. The rising adoption of electric vehicles and clean energy solutions is expected to drive demand for its products.

9. HCL Technologies and Wipro

These IT giants are involved in semiconductor engineering services, including chip design, testing, and embedded systems. Their global client base provides exposure to international semiconductor projects, making them attractive for investors seeking indirect participation in the industry.

Performance and Growth Trends

Over the last five years, semiconductor stocks in India have delivered remarkable returns. RIR Power Electronics recorded an outstanding CAGR exceeding 100%, highlighting the rising demand for power semiconductor devices. MosChip Technologies maintained consistent growth thanks to global demand for chip design and embedded systems. Dixon Technologies benefited from a surge in electronics manufacturing and strong domestic demand. Meanwhile, companies like Tata Elxsi and HCL Technologies leveraged their expertise in chip design, AI services, and technology solutions to strengthen their growth trajectory. Despite these successes, it is important to note that semiconductor fabrication is a long-term play; establishing fabs requires significant capital and time before yielding returns.

Why Invest in Semiconductor Stocks Now

India’s Semiconductor Stocks sector presents multiple investment advantages. The government’s ₹76,000 crore incentive plan demonstrates a strong commitment to building a domestic semiconductor ecosystem. Rising global and domestic demand for EVs, AI, 5G, and IoT devices ensures that semiconductor consumption will continue to grow. Additionally, global supply chain realignment, with companies diversifying away from China, positions India as an attractive alternative for chip manufacturing and sourcing. Expansion of design houses, packaging, and fabs in India is also creating a full ecosystem, which increases the potential for long-term growth and job creation in the sector.

Risks to Consider

Investors should also be aware of the risks. High capital requirements for fabs, long gestation periods of 5–10 years, and reliance on foreign technology for advanced chip manufacturing are key challenges. Global competition from established Semiconductor Stocks hubs like Taiwan, South Korea, and the US can also affect the sector. Therefore, a careful, informed, and long-term investment approach is essential when considering semiconductor stocks in India.

Future Outlook

India aims to become a significant player in the globalSemiconductor Stocks market by 2030. Government support, rising domestic demand, and increasing foreign investment are likely to drive growth. While short-term volatility is possible, companies focusing on chip design, packaging, and integration are expected to benefit steadily. Long-term investors may find stocks like Tata Elxsi, Vedanta, Dixon Technologies, SPEL Semiconductor, and MosChip Technologies particularly appealing.

Conclusion

Semiconductor Stocks are critical to the modern economy, and India is steadily building its position in this high-growth sector. While the country is still developing its manufacturing capabilities, companies involved in design, testing, and electronics integration offer excellent opportunities for investors with a long-term perspective. By focusing on firms with strong fundamentals, government backing, and clear growth strategies, investors can position themselves to benefit from India’s journey toward a robust semiconductor ecosystem.

Disclaimer: The investment tips and opinions given here are the personal opinions of experts. These are not the opinions of Riskydollar or its team. Riskydollar advises all readers to consult a certified financial advisor before making any investment

1 thought on “Semiconductor Stocks in India: A Complete Guide for Investors”